LEARN MORE ABOUT THE COOPERATIVE FINANCE ASSOCIATION

The Cooperative Finance Association, Inc. (CFA) is an agricultural finance cooperative based in Kansas City that offers a full range of financing products and financial services to agricultural cooperatives and their members throughout the nation. Read more about CFA here.

Production Ag Loans

Pre-pay Seed and Chemicals

- 4.75%* variable from 7/26/2023 through 9/30/2024

- 8.75%* variable from 10/1/2024 through 4/15/2025

Crop Inputs

- 6.25%* variable from 7/26/2023 through 2/28/2024

- 7.00%* variable from 3/1/2024 through 9/30/2024

- 8.75%* variable from 10/1/2024 through 3/15/2025

FarmKan

- 7.50%* variable from 7/26/2023 through 2/28/2024

- 8.25%* variable from 3/1/2024 through 9/30/2024

- 9.50%* variable from 10/1/2024 through 3/15/2025

Simpli-Fi by CFA

- Production Ag Loan up to $600,000 to finance all of your purchases from MWF. A simple, one-page application is all you need to start the loan process with CFA.

Input Advantage Loan

- Complete Financing Options for all of your farming operations. The loan process starts with a short, two-page application and submission of requested financial information to CFA.

2022 CROP INPUT FINANCE PROGRAM DETAILS

| Loan Types | Secured or unsecured (depending on loan size and credit quality). |

| Application Process | Simple application process. Credit application and collateral worksheet. |

| Interest Rates | Variable rate (contact us for interest rate quote). |

| Collateral Requirements | Lien position, assignment of insurance, buyer's notification and collateral requirements are based on loan size and credit quality. |

| Finance Program | Subject to CFA Credit approval and $200 loan fee advanced on the loan |

| Repayment Terms | Maturity date: 3/15/2025. No pre-payment penalty |

| Loan Fees | $200 per year for crop production loans. One loan covers all crops. |

| Approval Time | Typically, a credit decision is communicated to MWF as early as 48 hours of receiving a completed application. |

*As of July 26, 2023, variable interest rates are based on the CFA Advantage Rate. CFA interest rate indices are published here.

COMPLETE THE INPUT FINANCE PROGRAM LOAN PROCESS

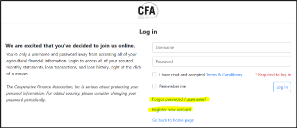

To renew your CFA loan for the 2023 crop year, please visit cfafsonline.com and complete the electronic renewal application.

Current borrowers who do not have an active login need to go to cfafsonline.com and click on “Register  new account”.

new account”.

- Fill in the questions with the correct information and then submit the form to finish the process.

- Once submitted you will receive an email from accountservices@cfafs.com with your access information. Please check your junk or spam folder if you cannot find the confirmation email right away.

- To complete the process, click the link in the email to verify your email address and then login to access your loan account information.

Documentation Required To Complete CFA Loan

The documentation required to complete the Input Finance loan application process is based on the amount of loan. Documentation should be sent to the attention of the Credit Manager at MWF, P.O. Box 188, 66071. You may also fax your information to the attention of the Credit Manager at (913) 273-0578.

For loan requests less than $600,000:

For loan requests $600,001 to $4,000,000:

- Current Bank Balance Sheet (with all schedules)

- Federal Tax Returns (past 3 years)

- Authorization for Release of Information

- Input Advantage Crop

- Income/Expense Report

- Annual Cash Flow Projection

- Creditor Information

For loan requests greater than $4,000,000:

- Current and Previous Two (2) Years' Bank Balance Sheets (with all schedules)

- Federal Tax Returns (past 3 years)

- Authorization for Release of Information

- Input Advantage Crop

- Income/Expense Report

- Annual Cash Flow Projection

- Creditor Information

FAQS REGARDING MWF'S INPUT FINANCE PROGRAM

Why does MWF offer CFA to their customers?

MWF has chosen CFA as a finance partner because of their thorough understanding of farm and ranch operations, and the financing requirements necessary for MWF customers. MWF and CFA understand the input dollar needs and cash flows that go into making your operation successful and profitable.

Are the interest rates variable?

Yes. The interest rates are variable and can change during the life of the loan.

Do I have to deliver and sell my grain to MWF or purchase my crop insurance through Team Marketing Alliance?

No. While MWF and TMA specialists are always available to meet your needs, you do not have to deliver your grain to MWF or purchase crop insurance through TMA.

Do I have to re-apply each crop year?

Yes. This is a non-revolving financing agreement approved for a specific crop year.

If approved for a loan, where can the loan be used?

The loan must be used for services provided by MWF including fertilizer, seed, crop protection products, application, lime, grid sampling, fuel and crop insurance.